Your credit score doesn’t change at random. It is calculated based on specific financial behaviors and patterns. Understanding these factors helps you make better financial decisions.

Key Factors:

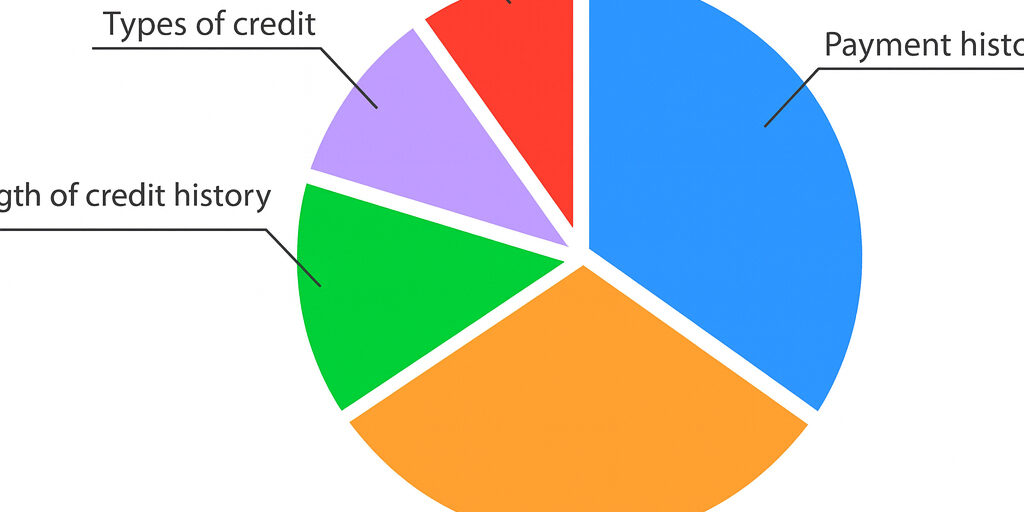

Payment History (35%): Late payments, missed EMIs, or defaults lower your score significantly. Timely repayment is the single most important factor.

Credit Utilization (30%): This refers to the percentage of credit you use compared to your total limit. Experts recommend keeping it under 30% to show responsible usage.

Length of Credit History (15%): The longer your accounts have been active, the better, as it gives lenders more data to assess your consistency.

Types of Credit (10%): A balanced mix of credit—such as credit cards, home loans, and personal loans—demonstrates your ability to handle different forms of debt.

New Credit Inquiries (10%): Applying for multiple loans or credit cards in a short span can signal financial stress and reduce your score.

Conclusion:

By focusing on timely payments, responsible credit use, and building a healthy credit mix, you can steadily improve your credit score. Good financial habits today directly influence your future opportunities.