Demystifying Credit Scores: What You Need to Know

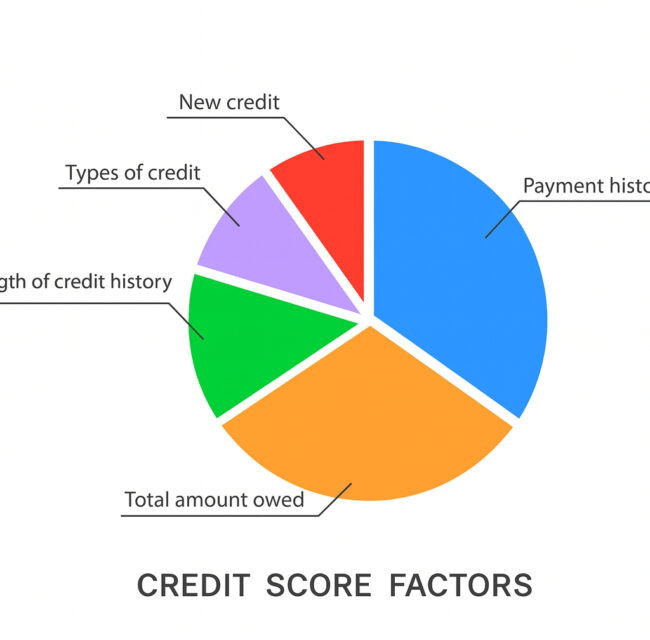

A credit score is a crucial three-digit number, typically ranging from 300 to 850, that signals your creditworthiness to lenders, landlords, and sometimes even employers. Understanding how credit scores work helps you make smarter borrowing decisions and opens doors to better financial opportunities. What Shapes Your Credit Score? Credit scores are calculated using several key…